Case Study

Algorithmic trade execution platform for brokerage desks

Trading & Investment Platforms | Brokerage Workflow Automation | Algorithmic Execution

Client Overview

AlgoTic is a platform designed to support stock brokers and brokerage desks in managing and executing algorithm-driven trading strategies, improving operational consistency and reducing dependency on manual trade handling.

Project Overview

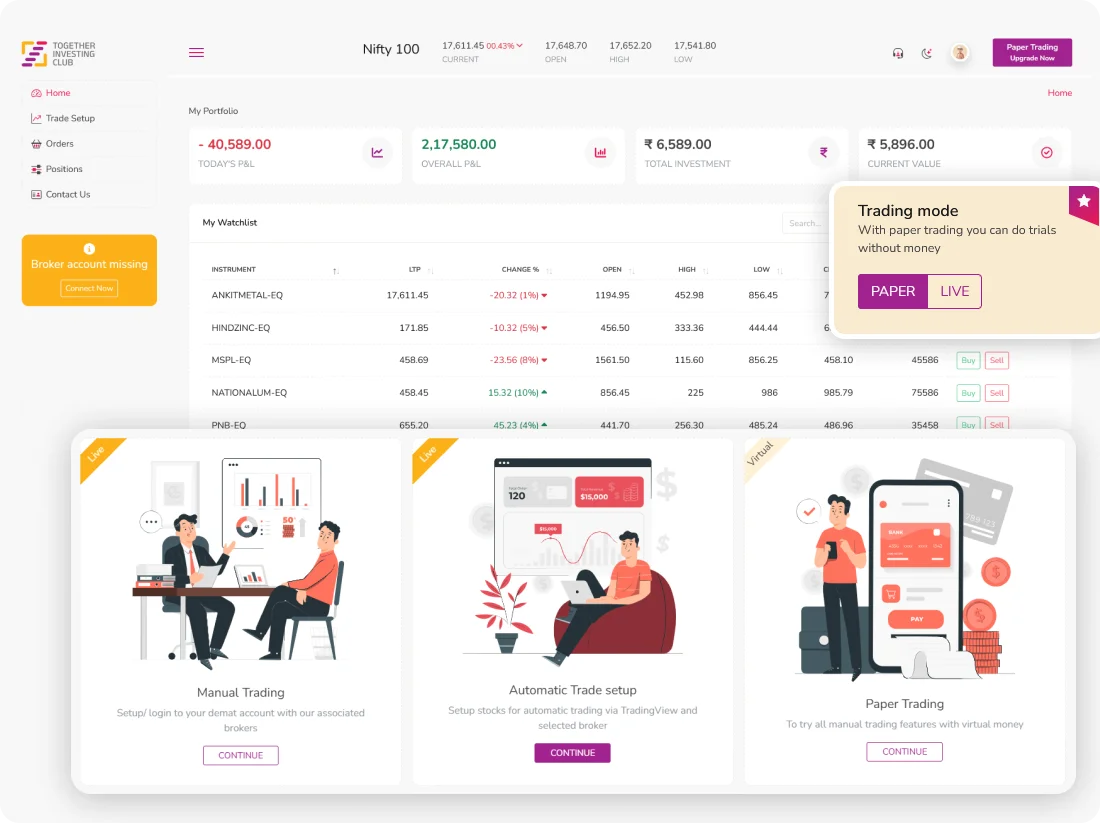

A web-based algorithmic execution system that allows brokerage teams to configure strategy parameters, trigger automated trading flows, monitor execution activity, and manage position visibility through a centralized interface.

Business Challenge

Brokerage desks managing multiple portfolios often rely on manual trade entry, which increases operational load and error risk in fast-moving market conditions. A controlled, workflow-driven trade execution engine was required to ensure consistency, reduce manual overhead, and support the introduction of new strategies without re-engineering core execution logic.

Business Impact

Provides automated trade execution to minimize manual intervention

Reduces risk of order-entry errors in high-frequency or repetitive workflows

Enables consistent execution behavior across multiple trading strategies

Establishes a structured, maintainable foundation for future scaling

Solution Delivered

We developed the execution engine and orchestration layer that processes strategy signals, executes trades through integrated brokerage APIs, and manages trade lifecycle state transitions in a structured manner. A React-based web dashboard provides visibility into execution status, positions, and account-level activity. The system architecture supports role-based access control, strategy parameterization, and audit-friendly transaction logging, enabling future scalability and governance.

Value Delivered

Tech Foundation

React.js

Java Springboot

MySQL

SonarCloud